Why now for active US value equities?

BCP Advisory Board member Alex Marshall-Tate

outlines why we think now is the time to consider a return to value.

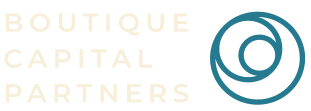

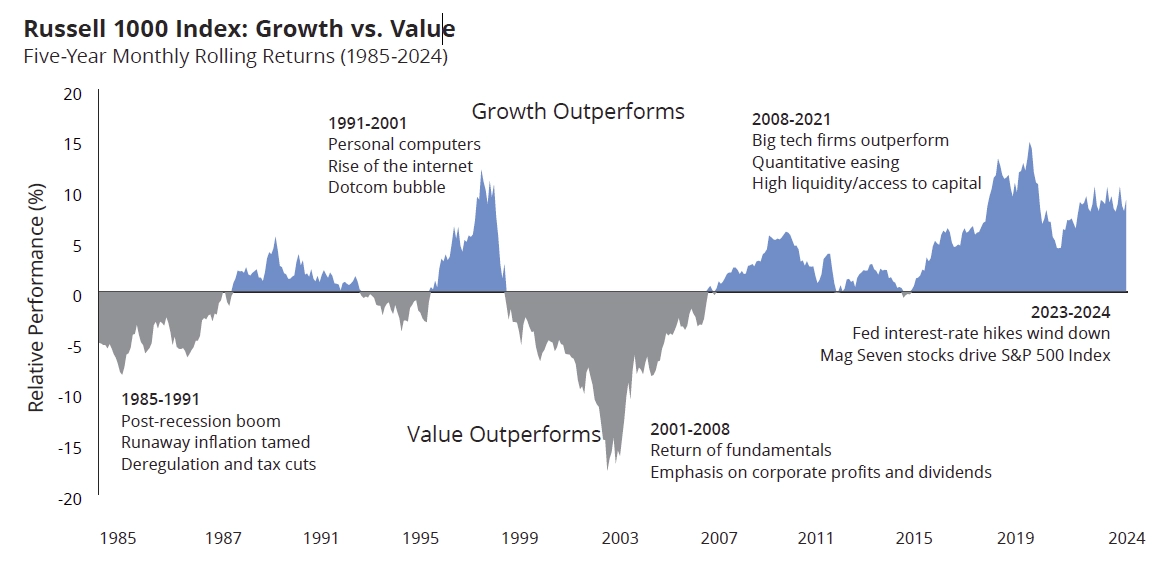

Charting recent patterns in Growth vs. Value

The past 10-year period to 31/03/2025, has seen the Russell 1000 Growth TR USD Index outperform the Russell 1000 Value TR USD Index by over +6.7% per annum (in USD). This material outperformance has led to valuations within thegrowth segments of the US equity market becoming increasingly elevated by historical standards, while many value-oriented segments of the market have continued to trade at a discount to their historical averages.

Source: BlackRock, 2025. Past performance is no guide to future performance. BlackRock Fundamental Equities, with data from Refinitiv as of 30/11/2024. Chart shows the representation of growth and value stocks (top quintile of each category) in

the S&P 500 Index across time.

While the strong performance of the Magnificent 7 benefitted many US equity investors in 2024, their success simultaneously also led to heightened levels of stock concentration and single stock risk within many US equity allocations. In a dramatic reversal, Q1 2025 has seen the Magnificent 7 experience significant falls from their recent peak valuations, elevating many of these stocks to key performance detractors within the S&P 500 index and many US equity portfolios. Despite recent share price falls, their continued prominence in the S&P 500 Index still leaves many investors excessively exposed to this group of growth stocks, and growth exposure per se.

A fresh start for Active Value

The value segment of the US equity market also offers more attractive characteristics in terms of its overall composition. While recent stock concentrations within the S&P 500 have proven challenging for actively managed large-cap growth strategies and large-cap core strategies, large-cap value managers in contrast may be facing an easier to navigate and potentially richer investment opportunity set going forward.

CG River Road US Large Cap Value Select Fund

CG River Road US Large Cap Value Select Fund is now available as a UK OEIC, exclusively available through Boutique Capital Partners.

Visit our website to find out more about Boutique Capital Partners

Contact: Rodger Kennedy

Boutique Capital Partners is a proud supporter of the Scottish Seabird Centre

¹Based on the composition of each market index as of 28/02/2025.

IMPORTANT INFORMATION

The value of investments and income from them may go down as well as up, and you may not get back the original amount investe d. Any

investments overseas may be affected by currency exchange rates. Past performance is not a reliable indicator of future resul ts and

targets are not guaranteed.